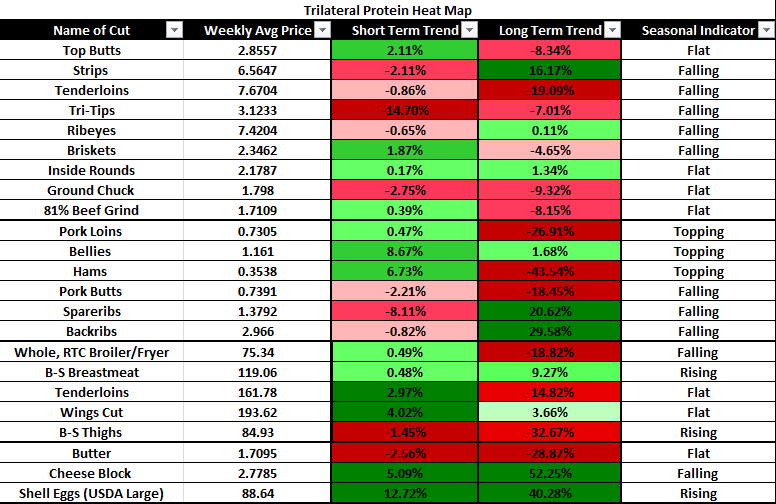

Take Aggressive Stance On Purchasing:

- Chicken Thighs

- Butter

Take A Passive Stance When Purchasing:

- Beef (especially strips and tenderloins)

- Pork Ribs

- Cheese

Boxed Beef:

Prices for the Choice boxed beef cutout averaged $204.54/cwt, $1.85 lower for the week, while Selects settled at $195.68/cwt., a decline of $3.93. A full week of harvesting after Independence Day holiday weekend meant sufficient supplies for demand, pushing prices lower. Looking into next week, a steady to weaker cutout is forecasted. Prices are certainly at attractive levels, especially given the past couple of months. However, large levels of production and a seasonal decrease in beef demand with the extra-hot weather are expected to win out and be a bearish force on prices. As we get into late-Summer, bullish forces that come into play are an improved demand for beef and retail ads. Retail ads have been dormant the past couple of months, but present prices should perk interest and keep buyers active in the trade. Supplies will remain abundant to act as a downward force and keep a lid on price rallies, given we do not see plant closures due to COVID responses.

USDA WASDE Grain Report:

Even with a higher old-crop carryover, USDA on Friday found lowered corn production and maintained demand for the 2020-21 corn crop, leading to a forecast of lower ending stocks for the crop. For corn, USDA bumped up the carryover into 2020-21 by 145 million bushels (mb) while lowering production with fewer acres to 15 billion bushels (bb) even. That led to a decline in ending stocks at 2.648 bb, slightly lower than the average pre-report estimate. Friday’s new U.S. and world ending stocks estimates were slightly bullish for corn, soybeans and wheat. Total demand for the 2020-21 crop was forecast at 14.625 bb. With lower ending stocks at 2.648 bb, that put the stocks-to-use ratio for the 2020-21 crop at 18.1%. The average farm-gate price was projected at $3.35 per bushel, a 15-cent bump from the June report.

USDA Livestock World Markets & Trade:

The global beef production forecast for 2020 is revised down 1% from the prior forecast on lower-than-expected slaughter in Brazil, China, and North America. Temporary processing disruptions resulted in lower production forecasts for Canada and the United States, while year-over-year growth in China beef production is revised down in the face of stiff import competition. Meanwhile, depressed domestic beef demand and lower cattle prices in Brazil are causing producers to delay slaughter. The global beef export forecast for 2020 is unchanged at 10.7 million tons. Estimates for Argentina, Brazil, the European Union, and Mexico are revised higher while those for Canada and the United States are revised lower. Gains for both Argentina and Brazil reflect weak currencies and strong Chinese demand. Furthermore, the current economic environment has limited domestic beef demand, increasing exportable supplies. During 2020, Argentina and Brazil are expected to export 25 and 26% of their respective beef production. For Brazil, this is a record high while for Argentina it is the highest proportion since the 1970s. Meanwhile, Canada and U.S. exports are revised lower on temporary processing disruptions and weaker demand from major buyers.

Demand for imported meat in China remains incredibly strong as the protein deficit caused by African swine fever (ASF) continues to drive trade. Despite headwinds caused by COVID-19 and disruptions to the economy and foodservice, demand growth during the first 5 months of the year exceeded expectations. As a result, forecasts for pork, beef, and chicken meat imports are all revised upward. China continues to increase its share of the global market, accounting for over 43% of global pork imports and 29% of beef. Altogether, China now accounts for 28% of imports by major traders, up from 20% in 2019. Despite rising imports and growing production of chicken and beef, total meat consumption is expected to decline 4% this year. Global pork production is raised 2% from the previous forecast to 96.0 million tons on higher expected output in China. Rebuilding of the swine herd continues as producers recover from ASF and take advantage of record-high prices, resulting in a 6% increase in the forecast. However, hog supplies are well below historic levels and pork production is forecast 15% lower year-over-year. In the United States, slaughter plant closures and measures to address COVID-19 related guidelines drives a 2% reduction in the forecast for U.S. pork production since April. Production is also lowered 2% for Brazil on reduced slaughter expectations. The European Union has faced limited COVID related impacts on slaughtering thus far and production is marginally lowered. Canada’s production is raised due to strong demand for exports. Global pork exports are raised to 10.9 million tons, almost entirely on strong demand from China. China’s imports are raised to 4.4 million tons, up from the previous forecast of 3.9 million tons. China’s demand continues to buoy global demand while crowding out demand from several more price-sensitive markets.