Best Value Buys

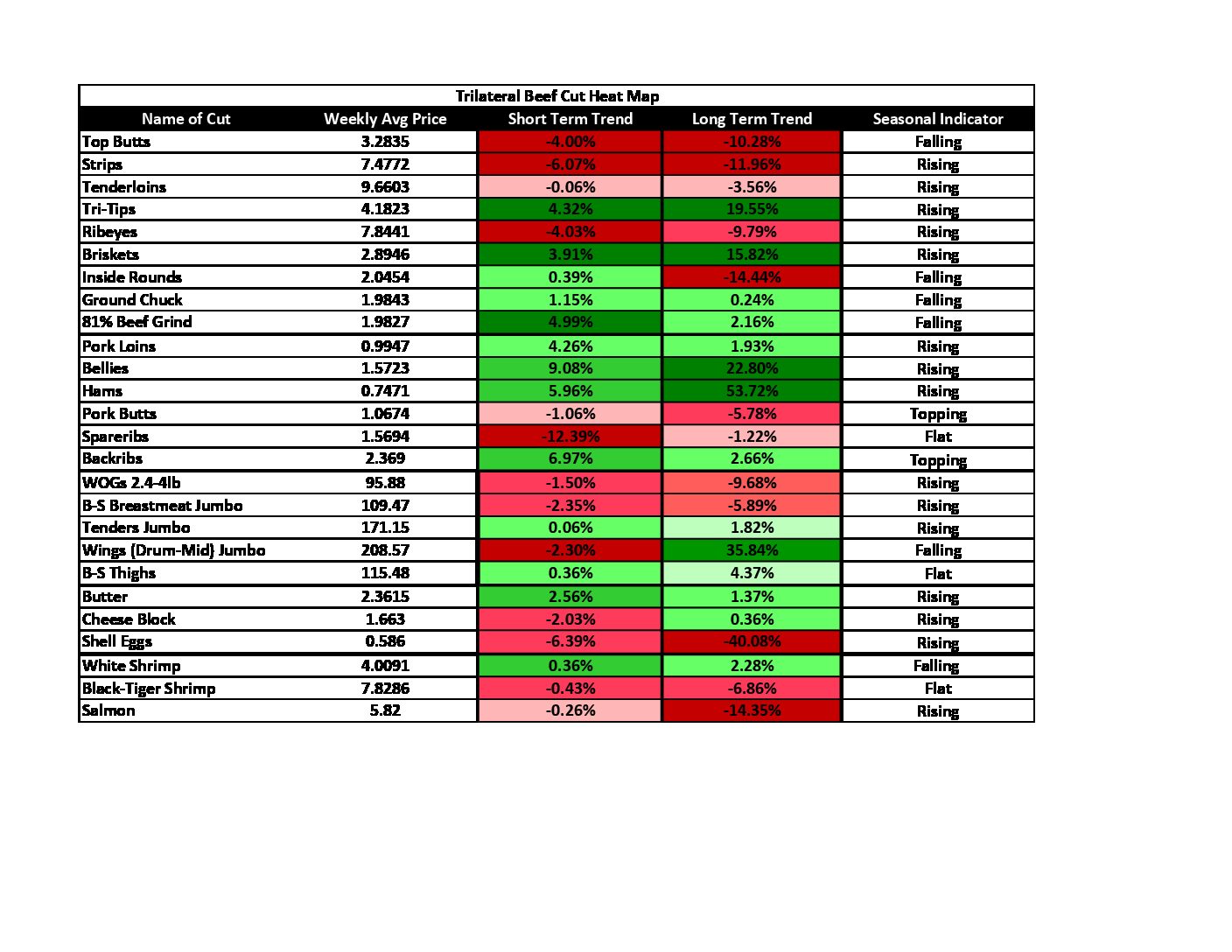

- Strip Steaks and Ribeyes are the best bet to add value. The poor spring weather has kept demand for these items down. Both items were lower last week (Strips down 6.07%; Ribeyes down 4.03%). Both are about 10% lower than this time last year. However, as temperatures improve, so will demand for these grilling items. The seasonal trend in both is rising. These items can also allow for the greater margins than most other cuts.

- Chicken Breastmeat is a great buy because it is in a rising, seasonal uptrend, but still trading below levels seen this time last year and last week. In addition, looking at wings being 36% higher than they were last year, one has to believe that QSR’s will once again begin to substitute breastmeat in boneless wing promotions to fight the rising bone-in wing cost. This will provide added support for the item.

- Eggs should be a long-term purchase at this point. Eggs seasonally rise this time of year. Prices are 40% lower than they were this time last year and that’s with a late Easter in 2019. With prices near all-time lows near (55 cents) and a memory for situations, like retail price wars and avian flu, a buyer should contract eggs near these levels as far as they can, and sleep like a baby.

What to Watch For - The Buyer's Perspective

- Despite trade wars and tariffs with China and Mexico (largest buyer of U.S. pork), most pork items are well above last year. The main culprit is African Swine Fever. Hams are 54% higher than this time last year. Who would of thought that would happen with all the increased production talk and the fears around tariffs? Ribs, loins and butts are near last year’s price levels. Seasonally, the complex rises this time of year.

- With the exception of wings (up 36% y/y), the poultry market is rather stable. Production is good, but we are in the part of the year that these items trend higher due to increased demand. There are concerns that poultry will have a wild-card year to the upside as it becomes a protein substitute in Asia with the spread of ASF decimating the pork supplies.

- Eggs are a buy. For the rest of the dairy complex, USDA reports that milk flowing into cheese plants remains steady versus the past several weeks but lower year-over-year. There are concerns that we may see a tighter supply situation. Milk production generally peaks in May, meaning production levels will be critical in the next few weeks to determine a price trend. Cheese stocks remain heavy but fresh cheese supplies remain in equilibrium with demand. Excessive price risk should be taken off the table.

- African Swine Fever is and likely will continue to be the story for 2019. The Ministry in China has reported herd losses of 22% already with no signs of infection rates slowing down. Most consider the Ministry’s numbers to be under-reported. Either way, the effects should be extremely severe. 22% of the Chinese herd is almost twice as much as the entire U.S. herd. Factor in that you can’t just replace a pig in a day and you realize that there will be repercussions for years to come. There is a report that researchers out of Spain have developed a vaccine, but there is little information on its effectiveness and how fast production can be ramped up. As China looks to supplement its protein needs for its people, you can look at this tide to lift the boats of chicken (dark meat especially) and beef too. On the flip side, there is a significant probability that the ASF eventually finds its way into the U.S. If this were to occur, we should see a roller coaster year of prices. Although emergency response and protocols will be much better than seen in China, it probably will not stop our trading partners from halting their imports of U.S. pork. This would have an extremely bearish effect on prices in the immediate as producers would flood the market with healthy swine and demand would vanish. However, over the course of a year or so, prices will skyrocket as overall supplies will be greatly diminished and demand will return.