Record Pork Production and ASF Have Futures Running Hog Wild

The Lean Hog Futures market has been taking participants for a wild ride as of late. Limit down one day, limit up the next. Many attribute this to major supply and demand factors at war with one another on a daily basis, with the market trying to decide which one will have greater effect. One day, China is running out of pork. The next day, U.S. continues to expand record production. I do believe the ASF situation will have great effect on the markets in the long run, both from a bullish case (lack of supply) to a bearish case (ASF arrives in the US). However, following new stories is a difficult way to manage risk. When are you wrong? Where are you wrong? When/where are you right? Is my position held hostage by the next media tweet?

When managing risk (or trading), price is all that matters. Thus, one should follow price. Decisions should be made on price projections and possibilities. This is where technical analysis comes to the rescue because it focuses on price.

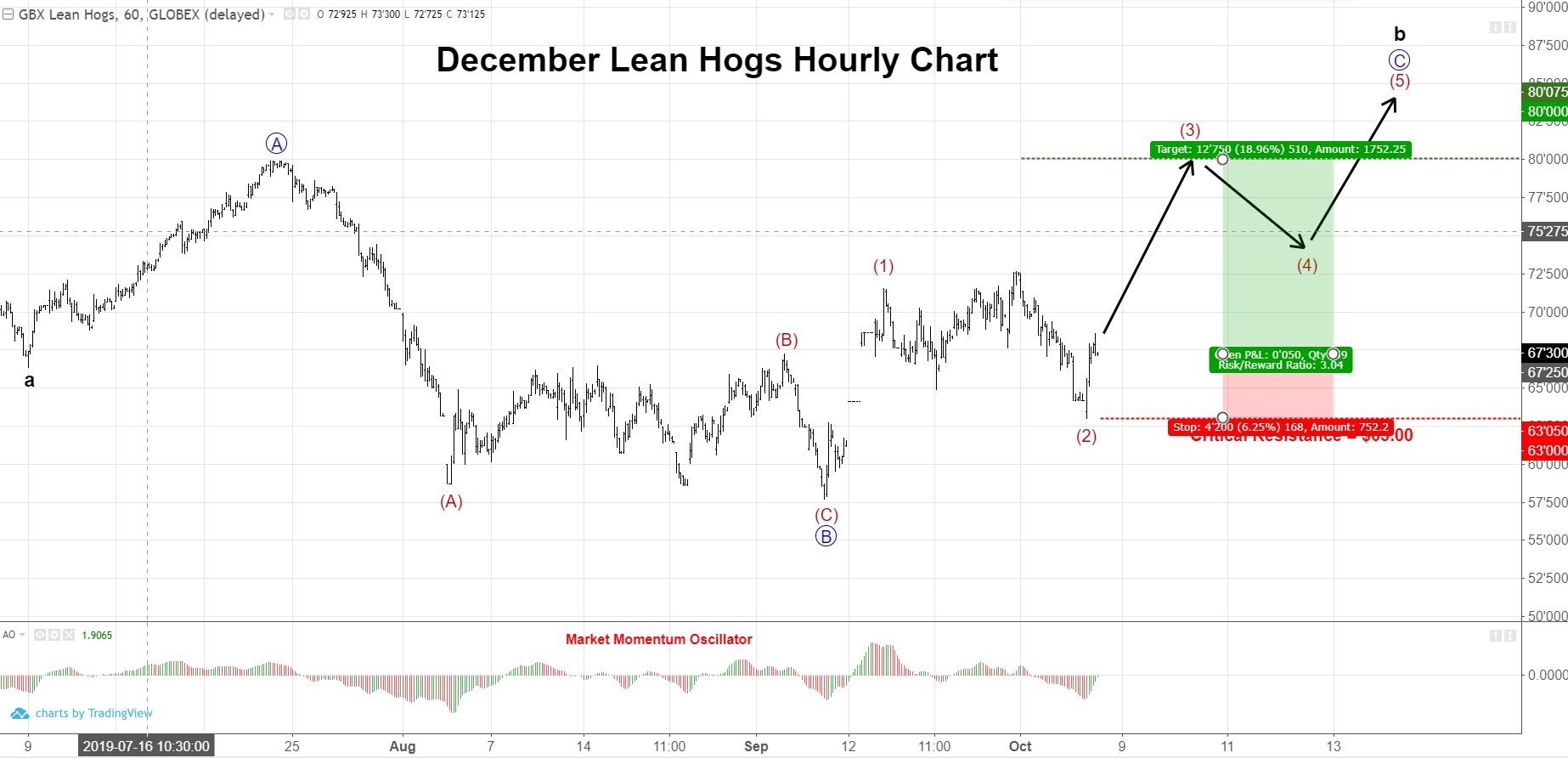

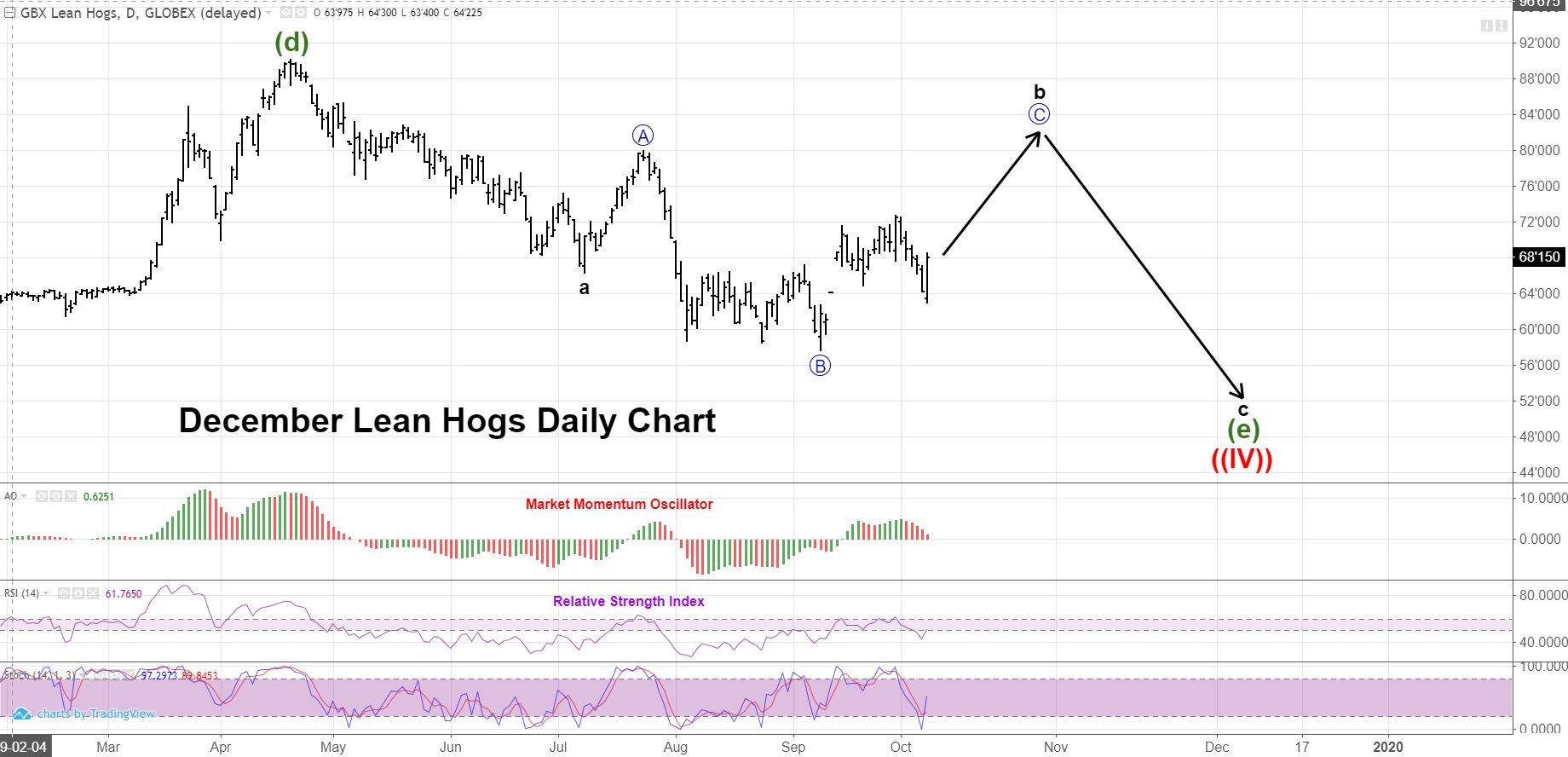

Taking a technical look at the Lean Hog market, we see the current, immediate trend to the upside. Our wave count has the market in wave (3) of C of b. This wave should play out over the next month or so, zig-zagging up in wave (3), down in wave (4), and up in wave (5). The momentum signature looks supportive for this outlook. Relative strength and Stochastics have plenty of room to run higher.

Once wave (5) of C of b is complete, expectations are for a violent move lower in wave c of (e) of ((IV)). This price break will probably surprise many and cause a lot of pain to hyper-bulls.

Critical support for this outlook is $63.00. The immediate target of wave (3) is near $80. Juxtaposing these two possibilities, we can define risk-reward for a long position at 1:3. This is recommended for trading.

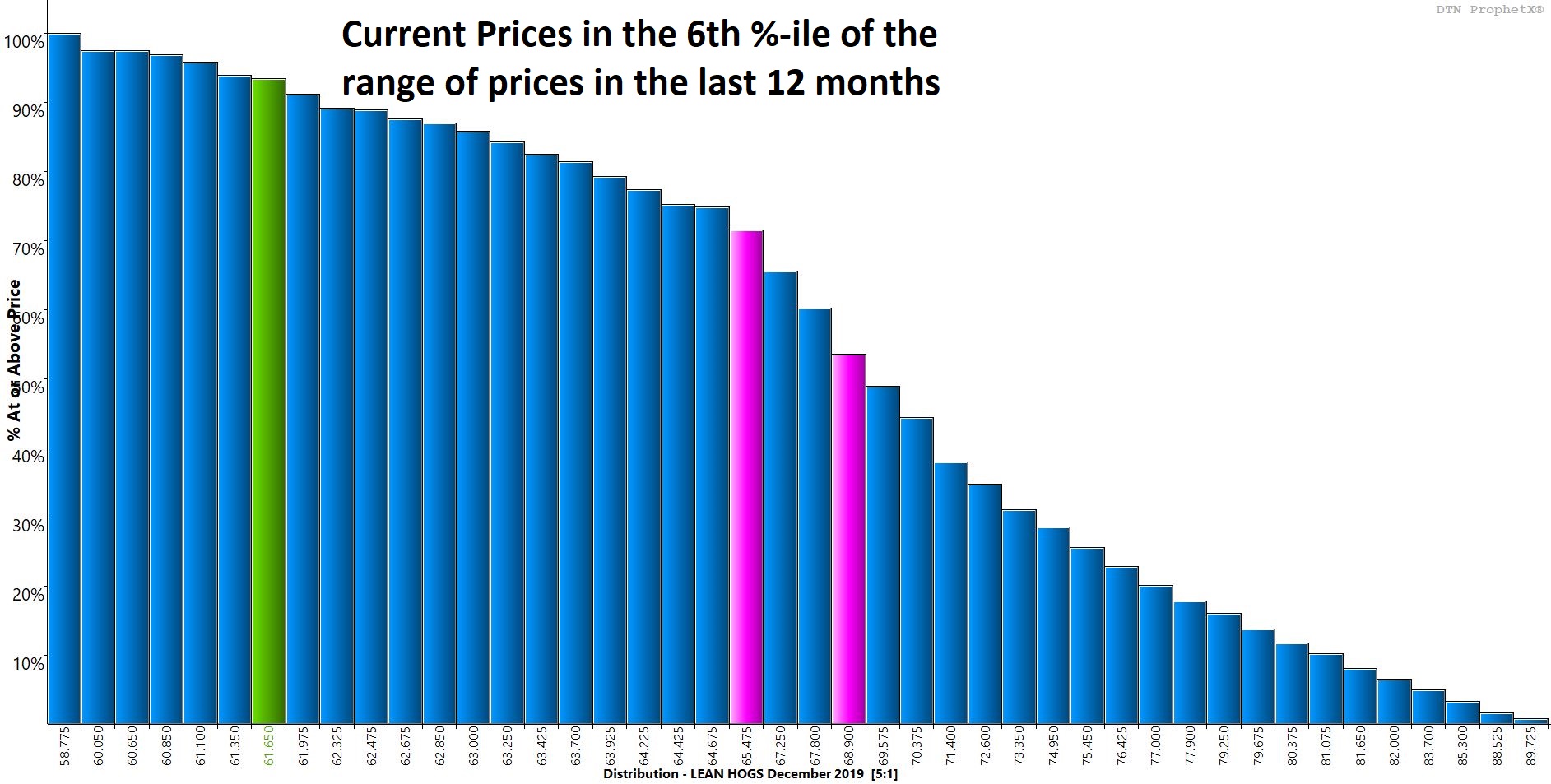

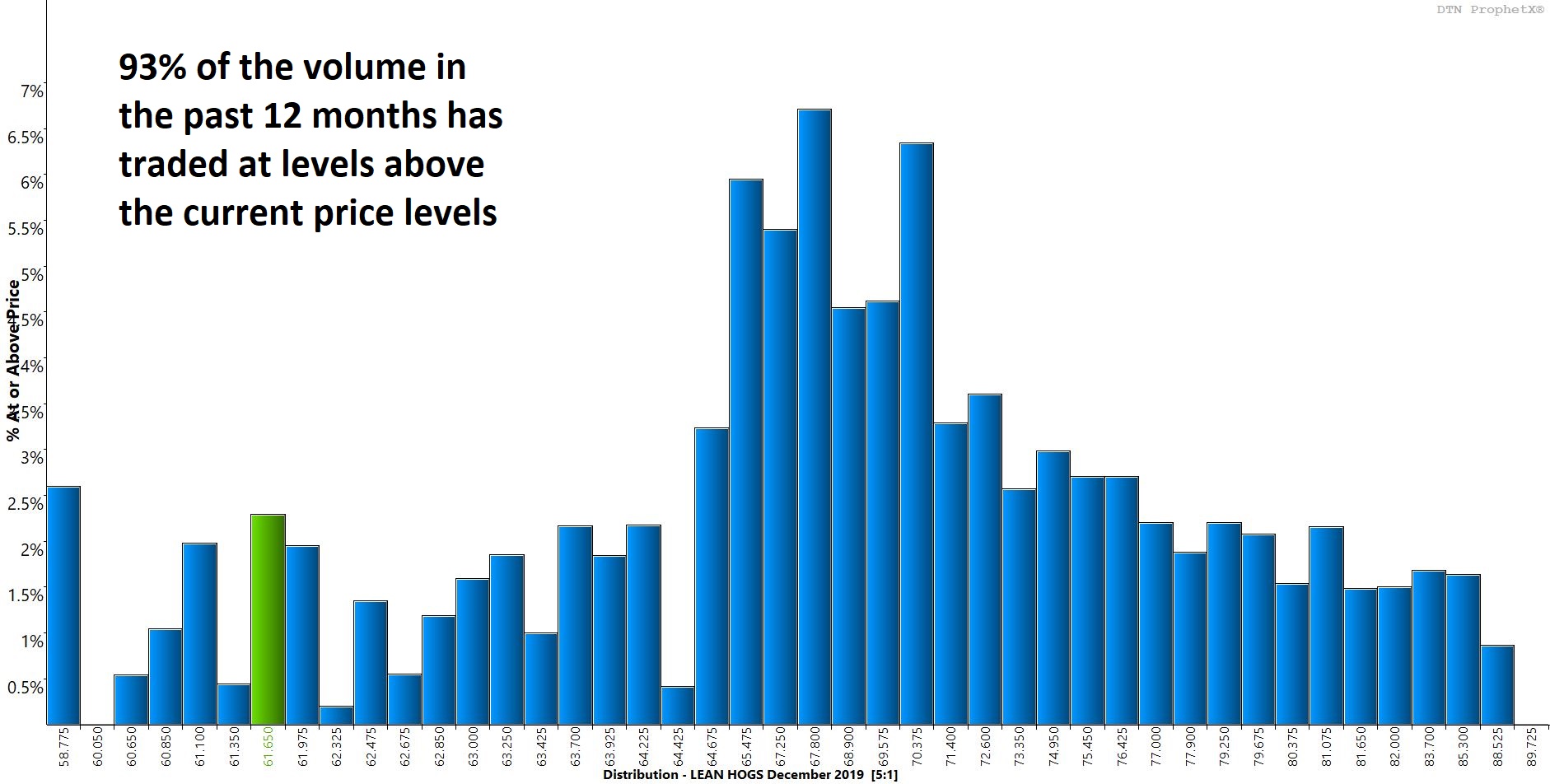

To bolster confidence in getting long in a very volatile market, you can see that current prices are in the 6th percentile of the price range in the last 12 months. Also, 93% of the volume traded in the past 12 months has occurred at levels above what the current market is offering.