Short-Term Reversal for Live Cattle Futures?

Live Cattle futures have had quite the historic move with 11 consecutive days of lower closes. I don’t think even in the days of Mad Cow scares and Oprah’s panic statements did the cattle futures experience that persistent of a downtrend. Looking at the current wave structure along with other market indicators, one can see that cattle is primed for a short-term reversal, but overall trend is still lower.

Supporting Evidence:

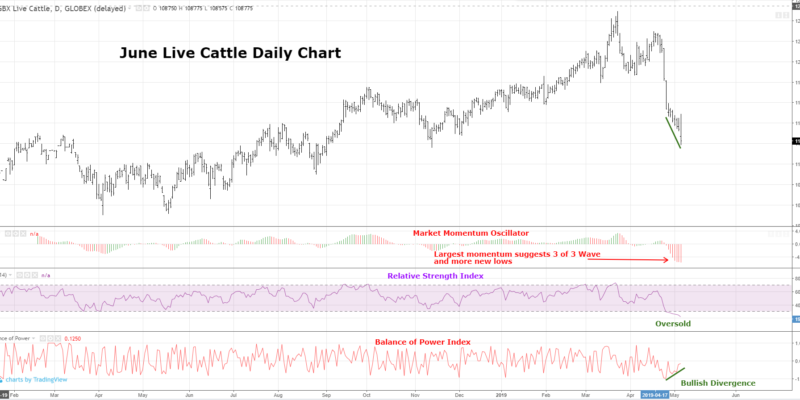

- Largest momentum of the move suggests overall, long-term is lower and we should see more lows on less momentum. Note: this is not as prevalent with cattle markets. They often mimic the stock market where panic is highest on the spike low, not the top. Also, the hourly chart shows divergence in momentum and price.

- RSI is in oversold. RSI levels are actually at the lowest levels in some time. I would not base a trading decision solely on RSI, but it is good supporting evidence to help pull the trigger.

- Balance of Power is showing divergence. Although we’ve seen lower lows in price the past week, there are higher lows in the Balance of Power indicator, suggesting the bulls may be in line to take charge of the short-term trend.

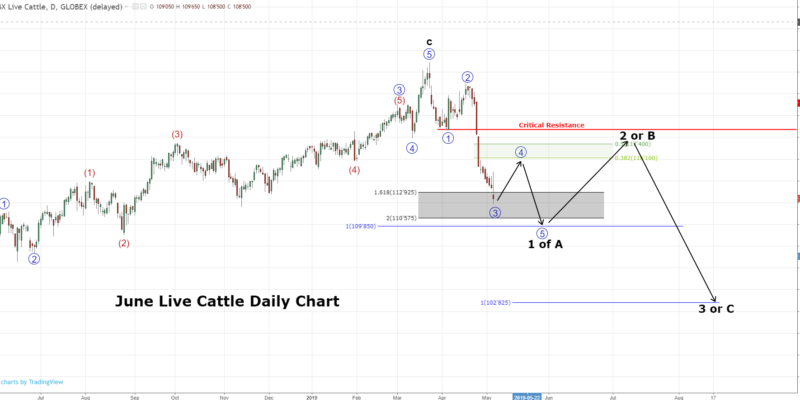

- Fibonacci relationships are in place. So far, the market has adhered nicely to what you would expect in a Fibonacci target that matches the wave structure.

- With a 5-wave move lower from the top, we have limited choices to what the wave could be. It is either an impulse wave (subdivides in 5 waves) and we can expect prices well below $100. Or it is a zig-zag (subdivides in 3 waves) and expectations are for prices to move to $103-area. Either way, the overall trend is lower and we should expect lower lows in the coming months.

Risk Management: Because wave 4 can never move beyond the end of wave 1, our critical resistance to maintain this outlook and remain short is 118.70.

Game plan for Live Cattle Futures:

Because the trend is your friend, the forecasted counter trend rally should be approached by buying back short positions and not so much getting very long. Flat positions should look to initiate short positions on 3 wave rallies that occur within parallel lines. Trying to get very long here in catching a counter-trend rally is a bad idea. As the saying goes, “those who try to pick tops, get bloody noses; those who try to pick bottoms get bloody…..”