The potential for a wheat breakout to the upside is coiling tighter as wheat markets are being buoyed by tightening supplies and rising prices in Russia and Ukraine.

The following bullets outline some of the more salient factors that either are affecting or have a strong potential to bullishly affect the U.S. wheat markets.

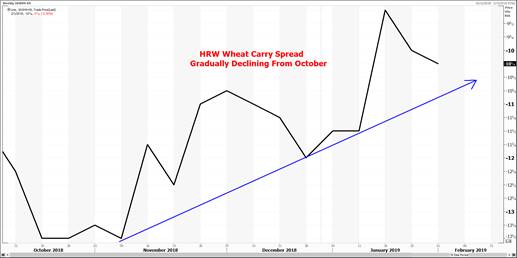

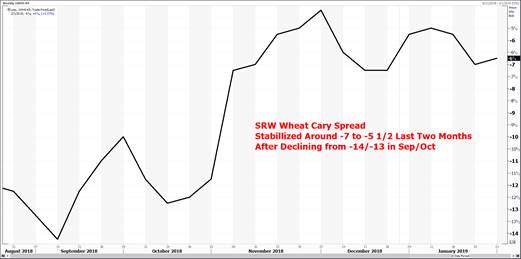

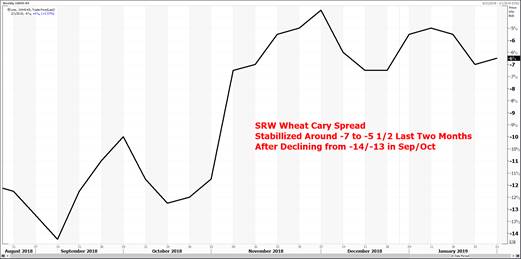

- A more bullish outlook for wheat by commercials has been evolving over the past few months as carry spreads have narrowed (lower percent of full cost of carry) while Gulf basis has been increasing. (Shown in the following charts.)

- The spread between the U.S. and Russia has narrowed substantially. Some reports this morning say that U.S. wheat is now believed to be cheaper than Russian on a FOB basis. However, U.S. exporters are still disadvantaged by higher shipping costs negating the FOB value gains.

The Kansas City hard red winter wheat carry spread has gradually declined since October.

- In what are perhaps attempts by Russia to subtly begin implementing export controls:

- Russia’s Agriculture Ministry has asked the country’s ports to start supplying it with grain export data on a weekly basis in what many believe to be a way “strengthen controls on wheat exports” and regulate domestic prices. Ag Resource estimates that February 1 stocks of Russian wheat could be 30% lower versus last year.

- Russia’s Ag Ministry just lowered its wheat export estimate by 1 mmt to 36 mmt.

- SovEcon is estimating Russia’s January wheat exports will drop to 1.9 mmt from 3.7 mmt in December.

- Bottom line: “Russian prices are rising, which is making Black Sea wheat less attractive for importers,” said Phin Ziebell, agribusiness economist at National Australia Bank. “This could provide an opportunity for U.S. wheat to make its way into Asia and the Middle East.”

Soft red winter wheat carry spreads stabilized over the last two months after falling in September and October.

- Similar to Russia, it appears that Ukraine is nearing its export threshold.

- Ukraine’s Jan 19-25 sea port grain exports were down 29% wk/wk.

- Reuters cited reports of the Ukrainian Ag Minister reiterating to exporters they are not to exceed 8 million metric tons of milling wheat exports for the marketing year 2018/19. Newswires reported exporters have already exported 83% of that total. Once that quota is achieved, only feed grade wheat would be allowed for export.

SRW Gulf Basis has increased gradually since September.

Argentina, another primary wheat competitor this year, recently had its production estimate cut 9% by the Buenos Aires Grain Exchange, pushing Argentina’s prices higher. This is obviously another advantage for U.S. wheat.

The coldest temperatures since the mid-1990s will spread across most of the SRW region and eastern parts of the HRW area this week. Winterkill is a real concern for those areas without protective snow cover.

Finally, Informa estimates all-wheat acreage will decrease this year.