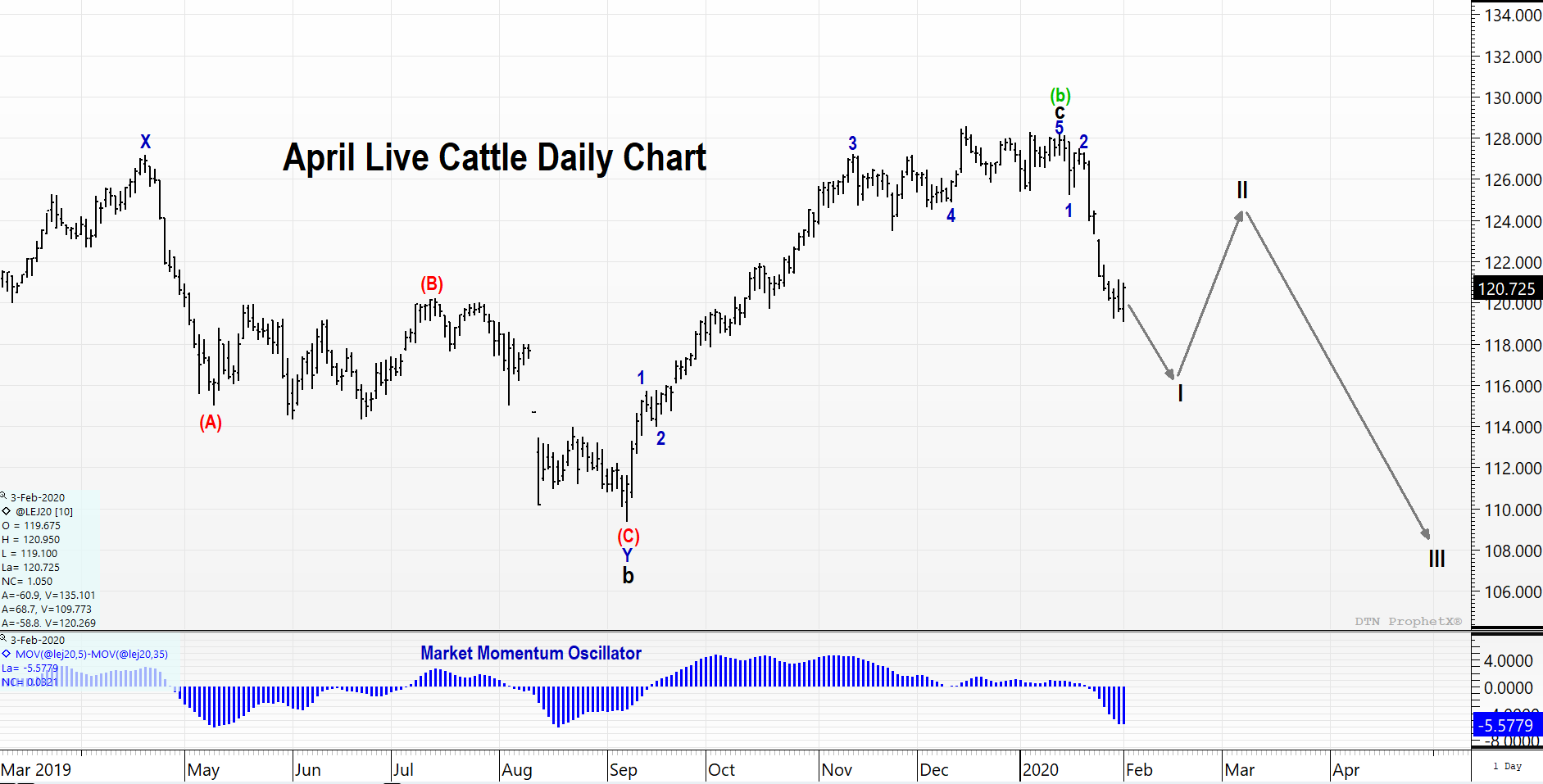

Cattle may be offering some selling opportunities in the coming days and weeks to join the downtrend that began in mid-January. The price action has been decidedly lower the past couple of weeks with building momentum. Expectations are for further downside with a couple of selling opportunities on pullbacks. Our most probable wave count and supporting evidence is below.

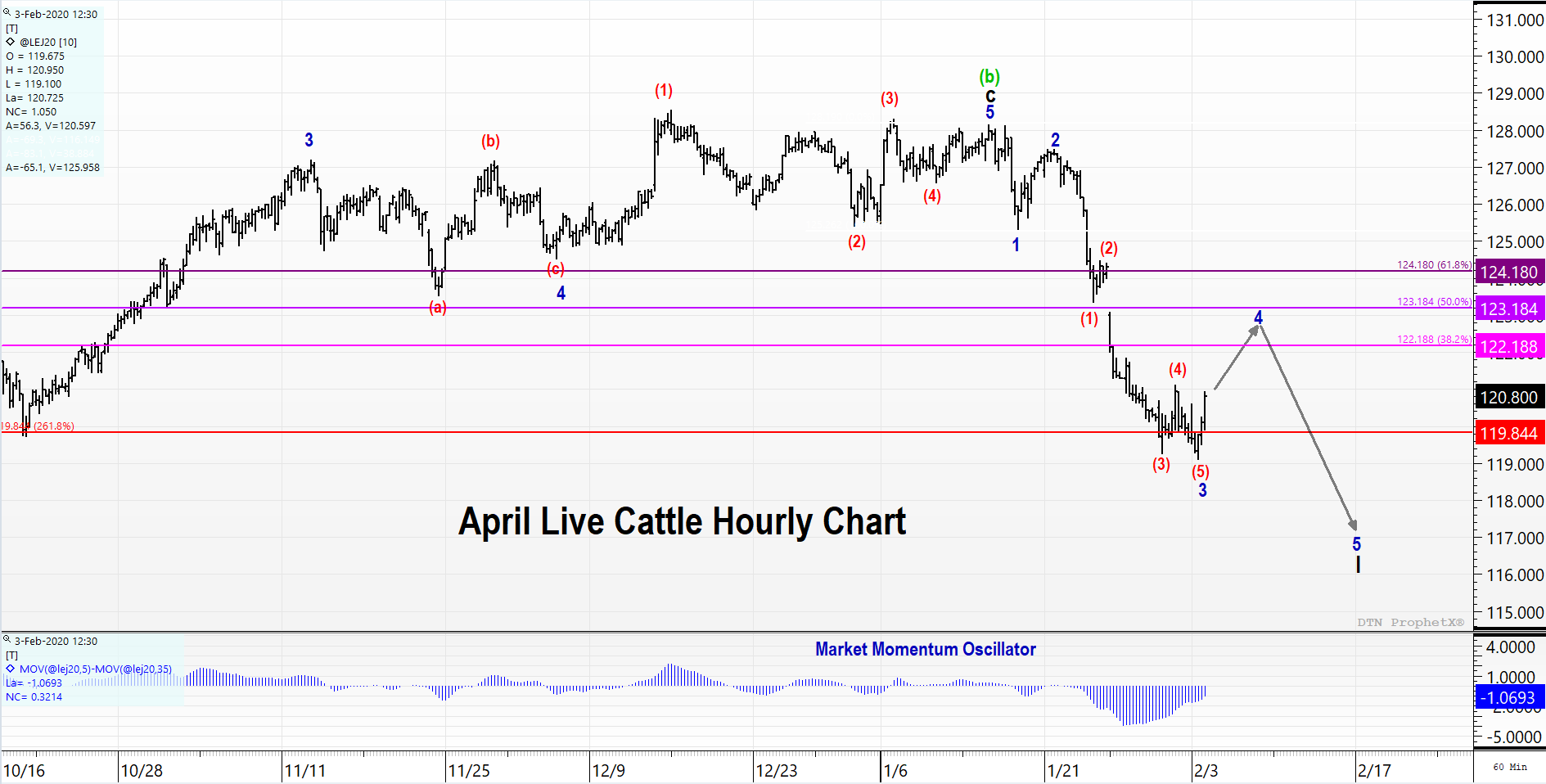

Hourly Chart

- Substructure looks good

- Wave 3 = 2.618*Wave 1

- Bullish Divergence on hourly chart calling for the end of Wave 3

Expectations are for Wave 4 to pull back up to $122.20, perhaps 123.20. If this counter-trend rally occurs in 3 waves and stays within parallel lines, confidence will increase greatly it is a selling opportunity.

Longer-term (4-6 weeks out), look for a wave II correction that will provide an excellent selling opportunity for a wave III decline.

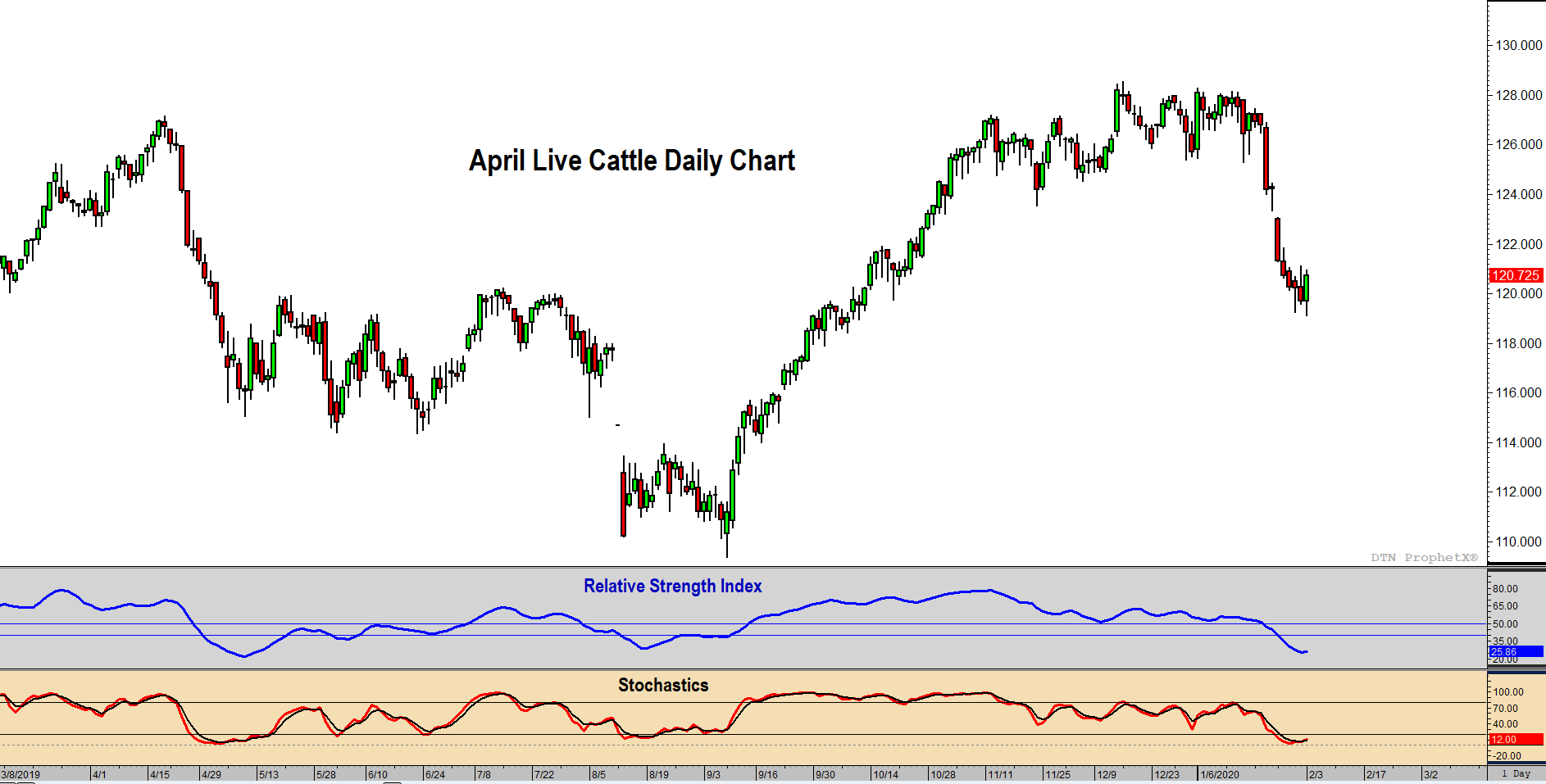

RSI has taken out the bull market support level of 40, suggesting a termination of the uptrend from Q4 2019. Currently, both RSI and stochastics are in oversold territory and turning up.

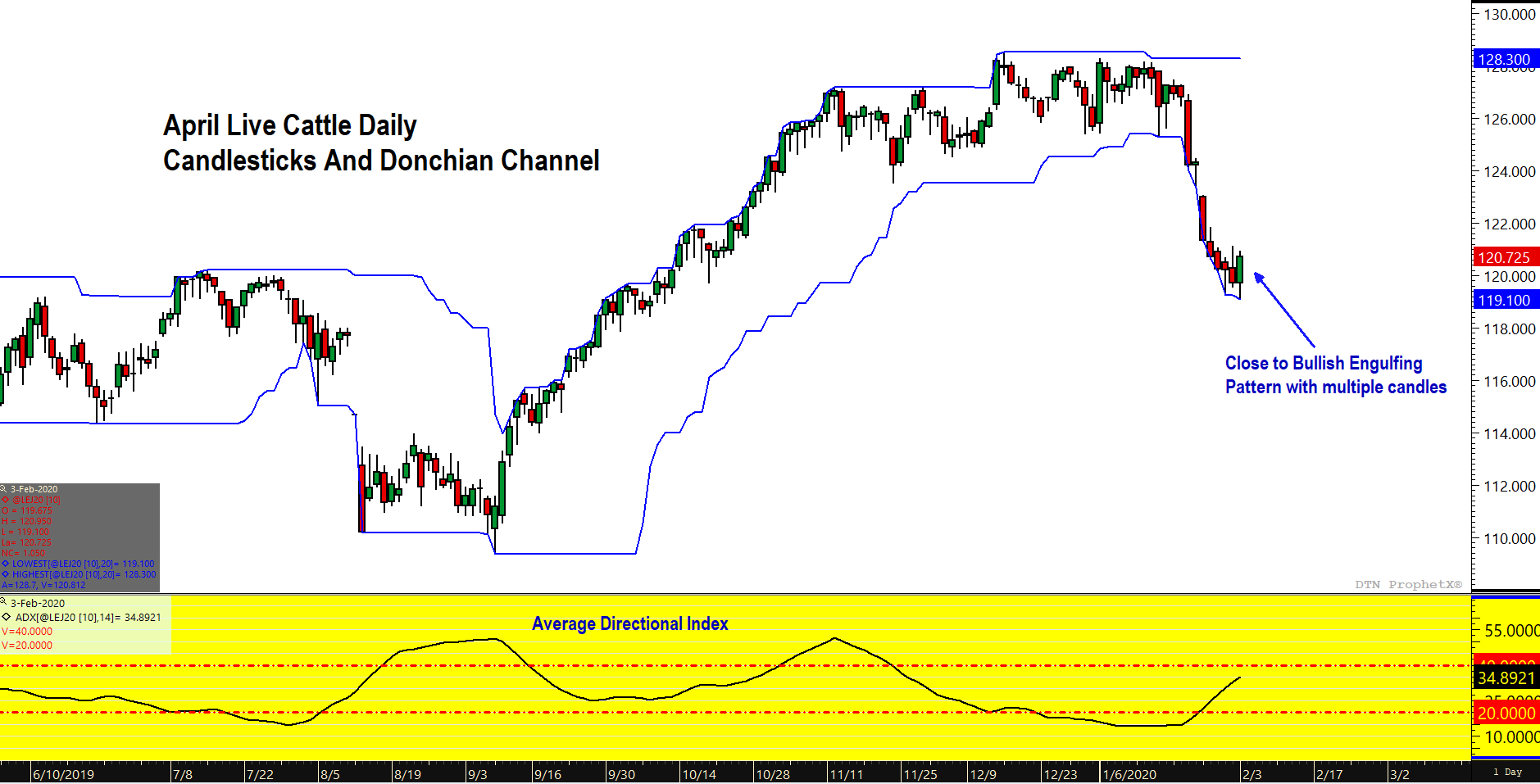

Looking at candlesticks, Monday’s candle is very close to a multiple candle, bullish engulfing pattern. Bullish Engulfing patterns would suggest 3-5 periods of price action in the same direction. Thus, the immediate forecast is for live cattle to rally the next 3-5 days, providing the next selling opportunity.

The Average Directional Index (ADX) confirms that the market is trending lower. Counter trend moves should be seen as opportunities to join the trend.