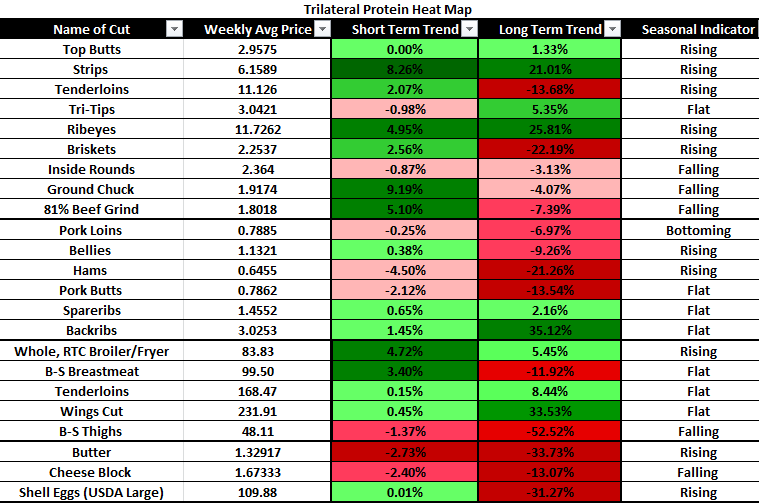

Take Aggressive Purchasing Stance:

- Breast meat

- Chicken Thighs

- Butter

- Eggs

Take Passive Purchasing Stance:

- Wings

- Pork Ribs

- Ribeyes

- Strips

USDA Cold Storage Report: The total supply of beef in cold storage at the end of October was 500.5 million pounds, 7.3% higher than a year ago but still 1.1% lower than the five-year average. It is not unusual for beef inventories to increase in the fall as end users prepare for year-end holiday demand. The slowdown in demand from the summer months also results in some product going to the freezer. This year the accumulation of product in the freezer during August and September was smaller than normal but end users appeared to accelerate their efforts in October. Low prices for fat beef trim may have also encouraged packers/processors to put more of this product in the freezer. Unfortunately, USDA does not give much detail as what type of boneless beef is currently in cold storage. It could very well be that this is lean beef. After all, USDA reported that 29 million additional pounds of boneless beef or +23% were accumulated in the West South Central region (TX, OK, AK, LA). But with more export product going out of Southern ports, it could well be that some of this is staged product for export or imported product, especially with higher imports from South America in recent months. Boneless beef in inventory in the Pacific region was up about 34 million pounds or 48% from a year ago, likely a function of higher exports as well. Inventories of bone-in beef cuts in the freezer at the end of October were 39.161 million pounds, 8% higher than a year avg. Inventories of bone in cuts have increased 24% since August but this is not necessarily a bearish factor. This could just be a function of efforts to have some freezer hedges for year-end holiday needs.

Total pork inventory was estimated at 448.2 million pounds, 26.8% lower than a year ago and 25% lower than the five year average. Export shipments have been very strong so far, which has limited the amount of product accumulated in cold storage. Prices for pork bellies were extremely high in October and that encouraged packers/processors to deplete the inventory of bellies in the freezer. The total supply of bellies in cold storage at the end of October was 19.7 million pounds, 56.7% lower than a year ago and 31% lower than the five year average. In the last five years belly inventories in October have increased an average of 12% from September levels. This year they declined 21%. Ham inventory was 123.2 million pounds, 29.1% lower than last year and 34% lower than the five year average. Tighter inventories help explain the rally in ham and belly prices last month. Inventory of pork ribs at 72.1 million pounds was 28.5% lower than a year ago.

Inventory of whole broilers and broiler parts at the end of October was 912.1 million pounds, 4.4% lower than a year ago but still 3.5% above the five year average. Inventories increased 2.7% from the previous month, in line with the average built up of the last five years. Inventories of leg quarters declined 7.4% from the previous month, which may be viewed as positive for prices. On the other hand the inventory of broiler breast meat at 242.6 million pounds was 28% higher than a year ago and 11% higher than the previous month. The combined inventory of beef, pork, chicken and turkey in cold storage at the end of October was estimated at 2.238 billion pounds, 7.7% lower than the previous year.

(Dow Jones) Fast Spreading Bird Flu Puts EU Poultry Industry on Edge: A highly contagious and deadly form of avian influenza is spreading rapidly in Europe, putting the poultry industry on alert with previous outbreaks in mind that saw tens of millions of birds culled and significant economic losses. The disease, commonly called bird flu, has been found in France, the Netherlands, Germany, Britain, Belgium, Denmark, Ireland, Sweden and, for the first time this week in Croatia, Slovenia and Poland, after severely hitting Russia, Kazakhstan and Israel. The vast majority of cases are in migrating wild birds but outbreaks have been reported on farms, leading to the death or culling of at least 1.6 million chickens and ducks so far around the region. In the Netherlands, Europe’s largest exporter of chicken meat and eggs, nearly 500,000 chickens died or were culled due to the virus this autumn, and over 900,000 hens died on one single farm in Poland this week, the countries’ ministries said.

USDA Chicken & Eggs: Broiler-Type Chicks Hatched Down 1 Percent: Broiler-type chicks hatched during October 2020 totaled 805 million, down 1 percent from October 2019. Eggs in incubators totaled 660 million on November 1, 2020, down 3 percent from a year ago. Leading breeders placed 8.07 million broiler-type pullet chicks for future domestic hatchery supply flocks during October 2020, up 7 percent from October 2019.

Shell Eggs Broken Down 13 Percent From Last Year: Shell eggs broken totaled 193 million dozen during October 2020, down 13 percent from October a year ago, but 5 percent above the 184 million dozen broken during the previous month. During calendar year 2020 through October, shell eggs broken totaled 1.86 billion, down 10 percent from the comparable period in 2019. To date, cumulative total edible product from eggs broken in 2020 was 2.40 billion pounds, down 10 percent from 2019.