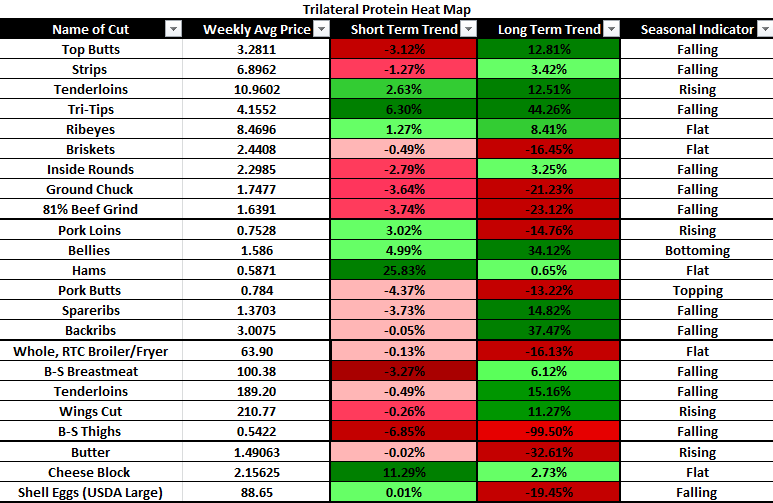

Take Aggressive Purchasing Stance:

- Briskets

- Pork Items (Except Ribs)

- Chicken Thighs

- Butter

Take Passive Purchasing Stance:

- Tri-Tips

- Pork Ribs

- Chicken Thighs & Tenderloins

Cash Cattle:

In the South, trade occurred at $101 in the first half of the week, and $102 later. This was steady to $3 lower than the previous week. Moderate trade in the North was mostly $101 live and $160 to $161 dressed, $2 to $4 lower than last week. Feeder Cattle exchanged hands at levels steady to $5 higher from the previous week. Calves were mixed, from $3 lower to $3 higher. Market Cows traded $2 softer to $1 higher. The tone for next week is steady-firm. Supplies are historically large, but should decline, especially in the South. Fed cattle prices are expected to trade defensively between $102 and $104.

The open concern is the convergence of backed up supplies of fed cattle with short placements from March and April. The date should be sometime in October as supplies of fed cattle should be restored to a more meaningful balance. Currently, full feed-yards are forcing cattle owners to sell current cattle to meet contracts for bought cattle or customer agreements. Some owners are refusing the urge to sell pointing to an extremely poor basis.

Boxed Beef:

Prices for the Choice boxed beef cutout averaged $222.12/cwt, down $5.27 for the week, while Selects settled at $207.60/cwt, a decrease of $5.54. Looking into next week, restricted seasonal demand and greater supply are likely to result in pressure on prices. As for the rest of September, probability points to lower prices as the grilling season is winding down and it’s still too early for holiday purchasing programs. Once we get into mid-Fall, exports should increase just before holiday buying. This, in conjunction with expected smaller cattle supplies, should push the cutout higher.

(Reuters) Germany Confirms 1st Case of ASF in Wild Animal

A case of African Swine Fever (ASF) has been confirmed in a wild boar in eastern Germany, the country’s agriculture minister said on Thursday. The case concerned a wild boar, not a farm animal, found near the German-Polish border in the eastern state of Brandenburg, German ag minister Julia Kloeckner said at a press conference.

A suspected case in a wild boar was announced on Wednesday night and tests from the Friedrich Loeffler Institute had confirmed the presence of the disease, Kloeckner said. There have been fears in Germany that its major exports of pork to China and other Asian regions could be threatened if the disease arrives in the country. Asian countries including giant buyer China regularly impost import bans on pork from regions where ASF has been discovered, causing a painful loss of business.

Kloeckner said the German government has been in contact overnight with China, a major importer of German pigmeat. Germany does not have a formal agreement with China about the disease, “So therefore we are in permanent dialogue,” she said.

Germany is stressing “the principle of rationality” in the case, which does not concern a farm animal, she said. She expected German pigmeat trade with other European countries to continue. Regionality means that buyers impose meat import restrictions only on a region of the supply country which has been hit by a serious animal disease, she said.

Germany exported some 158,000 tonnes of pork worth 424 million Euros ($501.6 million) to China between January and April 2020, double the tonnage in the same time in 2019, Germany’s national statistics office said.

Chicken Cuts:

Jumbo boneless/skinless breasts and leg quarters have been under pressure, while leg and thigh meat prices dropped precipitously because of low demand. For wings and tenders, it is a different story. The uptrend continues for clipped tenders and jumbo wings. However, there is a high likelihood that both products are close to the upper end of the spectrum. Expectations are for seasonal pressure to continue for the next few weeks for most items as overall supplies are expected to increase. July production was down 3.5% Y/Y, but in line with forecasts. Currently, year-to-date production is up 2.8 percent and is expected to end the year with roughly 2% growth.

Eggs:

The U.S. flock in production was up 0.3 million from the previous week at 311.6 million, with molted hens resuming production and pullets reaching maturity. Shell inventory was up 4.1% after a 1.5% increase last week indicating decreased demand that will influence future prices. There is some evidence of a return in the food service sector as the economy cautiously reopens but the incidence rate of COVID-19 is increasing in some regions.